Key Takeaways

- Langar is uniquely positioned to monitor, evaluate, and explain the public HealthTech universe.

- Our experts conducted proprietary analysis and derived 7 public market HealthTech sectors that allow us to quantify industry trends and make predictions.

- HealthTech companies have created billion of dollars of public market value, with the potential for trillions.

At the end of 2022, U.S. healthcare costs crossed $4 trillion and are now projected to reach $6.8 trillion by 2030. This translates to $19 thousand per capita (versus the per capita cost of $13 thousand today). This cost is due to a range of inefficiencies in the healthcare system that compound to create more than $1 trillion (or 25% of the total)* in wasteful expenditure.

Adding to the inefficiencies, the population is aging. 21% of the U.S. population will be over 65 by 2040, and chronic medical conditions are rising. 6 in 10 Americans have at least one chronic medical condition, and 4 in 10 have at least two.

Implementing changes to increase efficiency and reduce costs has become imperative. To that end, there are companies that have figured out how to generate revenue and profit by addressing these issues.

Enter, HealthTech.

HealthTech, Defined

HealthTech has a wide range of definitions depending on which organization, or social media influencer, you follow. At Langar, our interpretation of HealthTech is:

“Companies that develop technology to create efficiency in healthcare by addressing key pain points of patients, providers, payors, and hospitals.”

Using our definition, we were able to conduct a standardized systems-level analysis of the industry, of individual HealthTech companies, and of the pain points that these technologies are attempting to address.

The key pain points are important to understand as they ultimately lead to wasted time, resources, and inefficient workflows, which in turn contribute to the high cost of healthcare. To understand these key pain points, Langar objectively derived categories that correspond to each.

Langar’s Taxonomy

Our research team conducted a meta-analysis and tracked where almost every dollar is spent within the U.S. healthcare system.

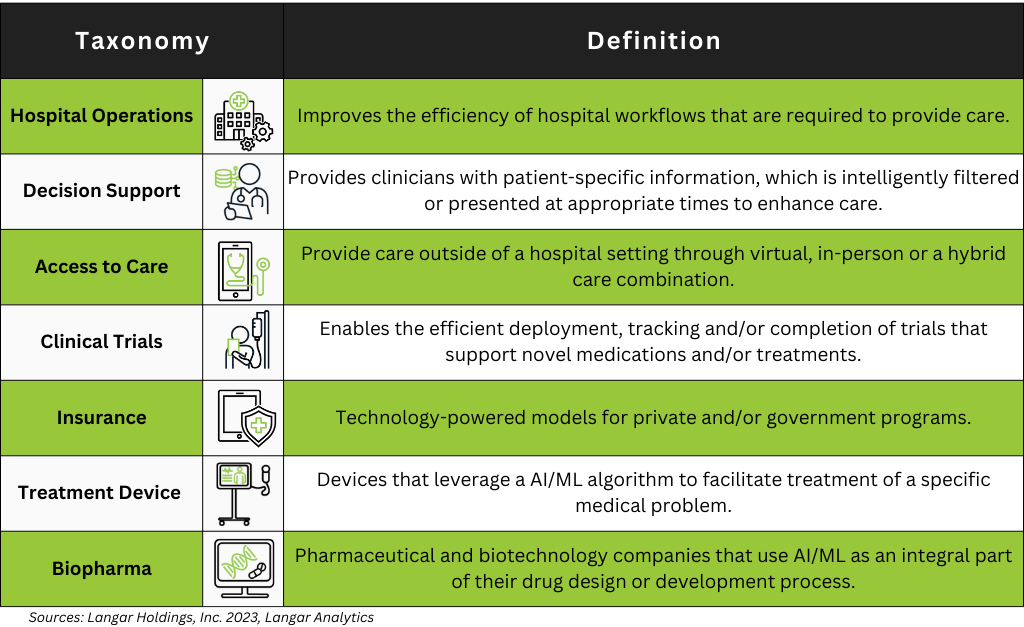

We found approximately one hundred areas of inefficient spending and, from there, defined 7 public HealthTech sectors that represent key pain points where wasteful spending occurs and where technology could make a difference. Also, many public HealthTech companies participate in multiple areas of healthcare. To prevent overlap, Langar bucketed companies based on which category generated most of a company’s revenue.

Table 1 defines each sector.

Using Langar’s proprietary analytics combined with expert review from our investment team, we calculated how much wasteful spending could potentially be saved using technology.

The result? $890 billion and climbing.

We Believe There Should Be A Standard Definition & Taxonomy

A standardized definition helps us more accurately classify companies and better understand the industry and its trends.

A taxonomy can provide a birds-eye view of the industry and make it easier to perform educational and sector-level research, which can elucidate where pain points still exist and what kind of potential future solutions could be built. We can also perform deeper risk assessments, formulate investment theses, and evaluate investment viability.

Our Public HealthTech Universe Results

Let’s take a closer look at the companies that make up the public HealthTech universe and how we applied our criteria.

There are over 6 thousand public healthcare companies in the U.S., Europe, Australia, and Canada. We applied our objective definition to each to determine if they are HealthTech, or not. For companies with multiple revenue segments, we reviewed their publicly available financials to ensure that at least 51% of their revenue was from a HealthTech product and/or service.*

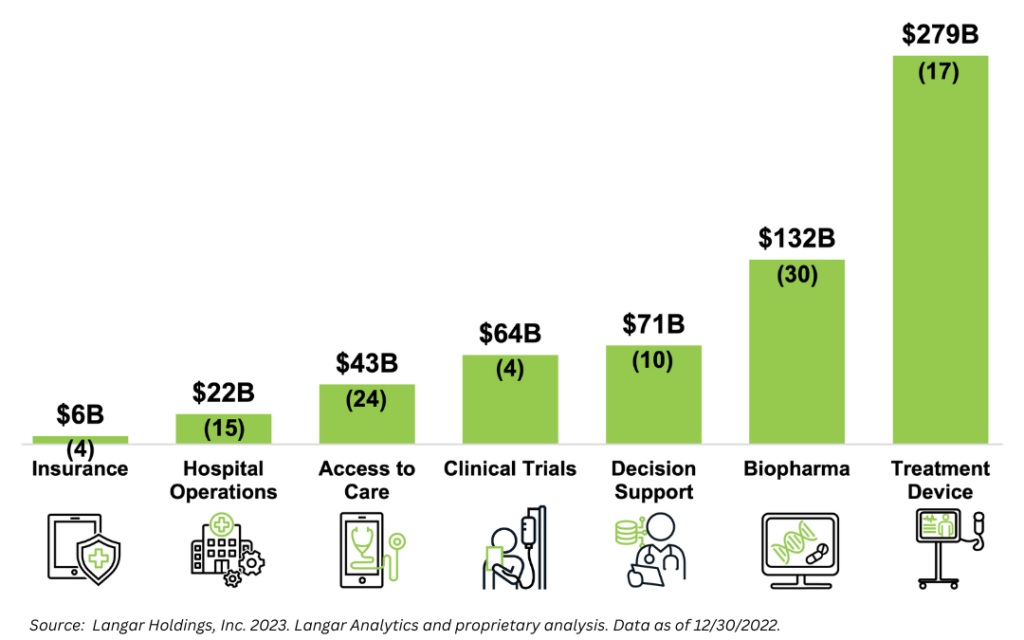

Our analysis resulted in 104 public HealthTech companies with a total market cap of $617 billion*. These companies were categorized based on the pain point they are solving. The breakdown of the number of companies within each sector and their respective market capitalization is shown in Figure 1.

Not Every Company Is HealthTech

There are companies that use technology to solve pain points in healthcare, yet still don’t fit Langar’s definition of HealthTech. This is because Langar’s SMEs created additional criteria to ensure higher accuracy of our taxonomy.

Let’s clarify.

First, as mentioned above, 51%+ of a company’s revenues must be from HealthTech products and/or services. In addition, these companies must have mature tech-enabled platforms that are core to their business.

We exclude companies that operate in a vice category. We also exclude companies that derive revenue from consulting engagements, pure exercise/fitness companies that don’t give intelligent feedback to the patient, health retail stores, and real estate companies that are landlords to hospital systems or clinics.

In addition, the pain points these companies are addressing must be close to the patient-provider interaction. For instance, a pure-play lab diagnostic company using new technology in their lab equipment is too far removed from the clinical treatment of a patient to label them as HealthTech.

Some Interesting HealthTech Insights

HealthTech companies go public 8 years (median) after they are founded, with Treatment Device having the highest median age of all sectors at 11 years. We find this interesting for a few reasons. Treatment Device companies have a long sales cycle, but that’s only one explanation for their older age. Most companies enter the sector through mergers and acquisitions because the market takes time to accept new technologies.

Another interesting characteristic of these public HealthTech companies is that 88% have at least one female in a senior leadership position (excluding marketing and human resource positions)*. According to a Harvard Business School study, female leadership could be a driver of success for companies.

It is worth noting the significance of public healthcare companies adopting technology. HealthTech is the fusion of healthcare and technology. Healthcare is an industry resilient to most market dynamics, as there will always be a need to treat sick and injured patients. Technology is a deflationary feature that can decrease a company’s operational expenses.

Thus, when healthcare companies properly integrate technology into their product and/or service, they should become fundamentally stronger, more scalable businesses. We believe that companies that fail to do this will have a limited future.

HealthTech Predictions

We now know how HealthTech is impacting the industry today. It is also important to consider how it will continue to affect healthcare going forward.

10-year predictions by Langar’s team are below based on our own analysis and industry knowledge (these predictions do not constitute investment advice and are for educational purposes only).

1 – The Treatment Device sector will continue to have the highest average market capitalization.

Currently, there are 17 Treatment Device companies with a combined market capitalization of $279 billion.* Going forward, this sector is likely to dominate value creation.

Why? A few reasons:

- Retail investors are familiar with many Treatment Devices as they often are on the receiving end of them as patients.

- Many treatment devices are patented, which protects them from widespread manufacturing and distribution. When the source of a technology is limited, the price to use the device remains high.

- Many devices require FDA approval, which further protects them from being duplicated in the marketplace.

- Once incorporated into practice, many of these devices become intrinsic to the standard of care and workflows, making them harder to displace.

2 – Access to Care will see the greatest number of new companies investing in the space.

Regarding the growth of the industry, Langar predicts that Access to Care will win the prize for new companies and established companies investing in the space.

The pandemic not only changed how we perform patient care but also altered how we deliver it. According to CMS data, in Q1 2020, 7% of Medicare patients used telehealth; at the height in Q2’2022, usage was 47%, and for the last 6 quarters, usage has been between 15%-20%.

While usage is down from the peak, it’s still 2x-3x higher than pre-pandemic levels in both rural and urban areas, indicating that this change is here to stay.

Access to Care companies enable synchronous and asynchronous interactions between a patient and a provider. This new pathway allows them to keep in touch and stay updated as needed.

In addition, being able to reach a provider from the comfort of your home, especially for non-urgent issues, results in less patient throughput in hospitals, emergency rooms, physician offices, etc. The overall effect improves the patient experience and allows sicker patients to receive the in-person care they need more quickly.

For these reasons, we predict that investments in Access to Care companies will only continue to rise and that the market will meet this need.

3 – Hospital Operations will increase in total market capitalization the fastest.

Upwards of 80% of hospital expenses are spent on fixed costs such as overhead, including rent, staffing, medical supplies, and the deflationary costs of invested assets. Of this, the cost of labor is the biggest piece of the pie.

As a result, fueling hospital revenues and increasing patient throughput or increasing the efficient use of resources becomes imperative. The biggest opportunity to improve margins is in the operating rooms.

During the pandemic, however, demand for these services declined. To cut costs, hospitals and hospital systems had to make changes. The most significant impact they could make on their overhead was to reduce staffing.

Now, in the post-pandemic era, the need for patient care and surgeries is rising. Patients who couldn’t access care before are making their way into the hospital. Yet, staffing now falls short of demand. Fixing the disruption in the labor force within the healthcare system is essential to making it more efficient and cost-effective.

Administrative costs, including administrative tasks and billing, are another area that can be improved within the hospital system, as they account for about $250 billion (28% of the addressable $890 billion) of wasteful spending*.

Hospitals will increasingly look to partner with companies that provide technology to help decrease fixed expenses, improve staffing models, and improve operating room workflows.

Another reason this sector will grow quickly: companies are viewed as pure technology SaaS (software as a service) companies with the least regulatory hoops to jump through.

4 – Decision Support technology will become ubiquitous.

With the incorporation of artificial intelligence into healthcare decision-making to help reduce errors and save time and money, it only makes sense to predict that the use of Decision Support companies will become the norm.

While nothing can replace the years behind a physician’s training, Decision Support technologies can improve turnaround time, gather data, and improve patient outcomes.

5 – More non-healthcare companies will adopt HealthTech to enter the healthcare space.

We are already seeing this happen. Amazon is planning to acquire One Medical, and Walmart is expanding its healthcare arm.

While the Langar criteria for HealthTech currently excludes these companies, their footprint within HealthTech will continue to grow. With their already established widespread customer base, these companies are uniquely positioned to use HealthTech to provide solutions and capture a portion of the healthcare market.

Why would anyone want to enter the maze of healthcare? For the reasons mentioned earlier. Healthcare is a stable industry that operates independently of other market dynamics because there will always be sick patients to treat (e.g., during the pandemic, the value of the healthcare industry remained unchanged), and technology is deflationary.

6 – New HealthTech sectors will arise.

Langar’s team continuously monitors the private HealthTech markets, as well. To that end, we have already identified two additional sectors: Lifestyle Wellness and Prescription Management, that exist in private markets but not yet in the public markets.

We predict that within the next decade, companies within these sectors will likely go public, paving the way for more companies in new sectors to do the same.

Final Thoughts

As healthcare costs continue to rise ($6.8 trillion by 2030, projected), inefficiencies will rise, and so will the number of pain points within healthcare that technology could address. This creates more demand for companies to enter the HealthTech industry and attempt to solve these issues. It also prompts older healthcare incumbents to pivot to become HealthTech companies.

These industry shifts create a niche opportunity for investors, especially in the U.S., as we have one of the most inefficient systems in the world.

*Source: Langar Analytics and proprietary analysis. Langar’s public HealthTech database as of 12/30/2022. It includes companies where a public M&A has been announced but not closed. It does not include completed M&A companies that have been delisted.

Pingback: HealthTech. The New Kid On the Block That is Poised to Change Healthcare As We Know It – Updates By Diego

Pingback: HealthTech. The New Kid On the Block That is Poised to Change Healthcare As We Know It – Financial Pupil